You’ve heard a million great things about solar power — clean energy, utility savings, tax benefits — but how do you pay for solar panels? If you’ve started exploring solar financing options, you’ve likely heard about solar leasing.

A solar lease is a third-party ownership (TPO) solar financing option. With a solar lease, a solar panel company owns the solar panels and the homeowner pays a fixed monthly fee to keep the solar panels on their house and use the energy that they produce.

Solar leasing has traditionally been a popular strategy for investing in solar energy at a lower cost than purchasing panels. Over the past decade, however, the cost of solar has declined significantly.

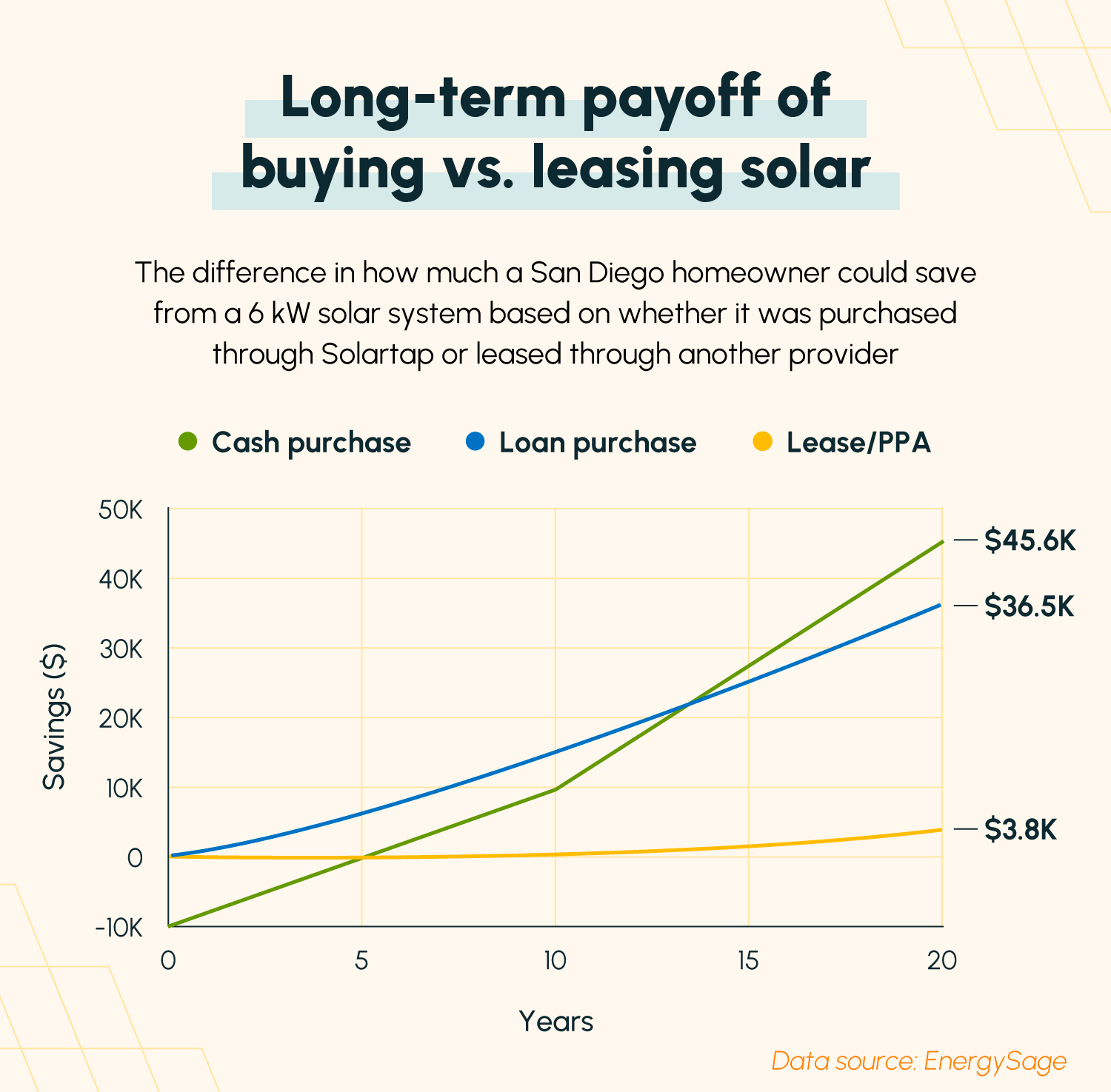

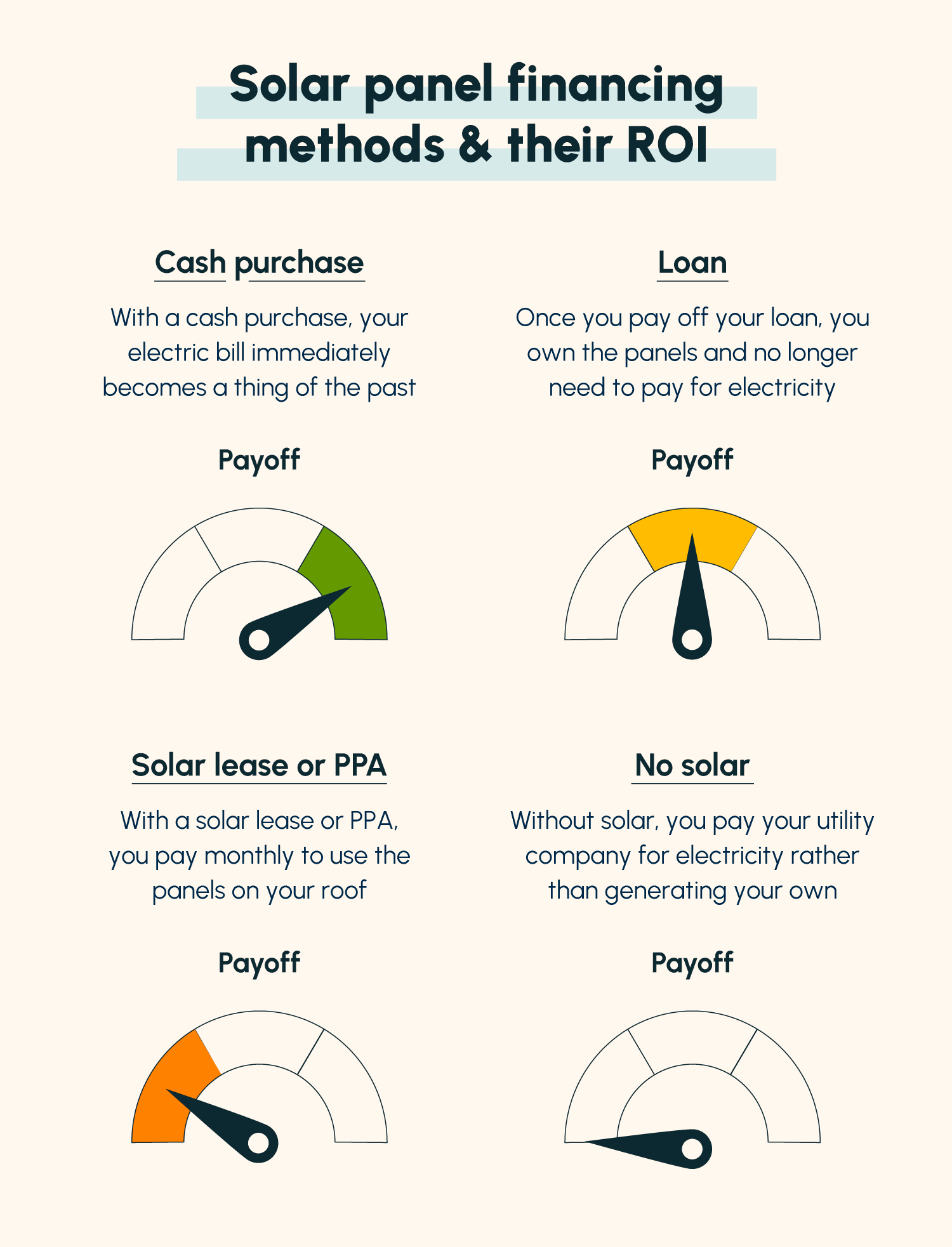

Now, the return on investment (ROI) of solar leasing is much lower than financing a system. For this reason, purchasing or financing is the financially wiser option. We’ll dive deeper into this later on.

The following guide will unpack everything you need to know about solar leasing, including its benefits and downsides.

How Does Leasing Solar Panels Work?

Leasing solar panels works very similarly to leasing a vehicle or a living space — you don’t technically own the panels, but you get to use them for a fixed monthly fee paid to the leasing company. You can then use the energy the panels produce to offset your electricity bill.

As long as the value of the energy you’re producing exceeds the cost of your lease payment, you’re saving some money with a solar lease. Essentially, you’re trading your monthly bill to your utility company for a slightly cheaper bill to your solar company.

That said, if you use more energy than your solar panels produce, you will likely need to supplement the energy you get from your panels with energy from the grid — the massive network of power plants and transmission lines that generates and distributes energy.

It’s important to note that, while solar leasing can save you some money, you can save significantly more by purchasing your own panels with monthly financing. Read on for a breakdown of how your ROI from leasing and purchasing solar panels can differ.

Solar Leasing Pros and Cons

There are a lot of considerations to weigh before deciding whether to lease solar panels or buy your own system. We outline these considerations below.

Pros of Leasing Solar Panels

First, let’s unpack the appeal of leasing solar panels.

- Minimal upfront costs: Much of the appeal of a solar lease comes from the absence of upfront costs. In most cases, hardware and installation are covered by the solar provider, eliminating costs that deter some from purchasing their own solar system.

- Less responsibility for maintenance: With a lease, the company professionally manages and monitors the panels on your roof. If panels get damaged or need maintenance, you are not responsible for fixing them — the company is. This can take some stress off of the homeowner’s shoulders. Of course, most purchased equipment comes with at least a 10 year warranty, meaning you likely won’t have to pay a dime for malfunctions whether you buy or lease your panels.

- Energy production and savings guarantee: In a lease agreement, the company guarantees a certain energy output. If at any point your panels don’t generate the agreed-upon amount, whether that be due to significant cloud coverage or a system malfunction, the company will refund you the difference.

- Predictable monthly payments: A solar lease contract will specify your fixed monthly lease payment and price escalator (which we’ll discuss in greater detail shortly). This makes it easy to budget for solar.

Cons of Leasing Solar Panels

Before settling for a lease, you should familiarize yourself with the disadvantages of this arrangement.

- Significantly lower savings: With a lease, you’re still paying for your energy every month. And you’ll likely be locked into a payment agreement for 20-25 years. By the end of your agreement, there’s a decent chance that you will have paid as much as it would have cost to purchase the solar system. See the diagram above for a look into the cost of leasing vs. buying solar panels.

- Regular price increases: Solar leases include price escalators, meaning that your monthly energy price will increase to reflect the rising cost of electricity. The average price escalator is about 2.9%-3.9% per year. If the cost of electricity doesn’t increase at your escalator rate, there’s a chance you’ll end up paying more for your solar lease than you would have been paying your utility company.

- No home value improvement: Buying solar panels increases your home value, making it easier to sell in the future at a higher price point. However, since you don’t own leased panels, they do not add any value to your home.

- No solar incentives: Solar tax credits and other incentives are offered to those who purchase solar panels. When you lease your panels, those benefits, including the solar investment tax credit (ITC) which covers 30% of the solar panel installation cost for systems installed between 2022 and 2032, go to the solar developer instead of you. You’ll also miss out on rebates and other incentives.

Basic Terms of a Solar Lease

Every solar lease is a bit different, but across most leases, there are some common terms to be aware of.

The first of these is the term length of the lease. Solar leases usually last between 20-25 years, which aligns with the average lifespan of a solar system.

So if you’re considering a solar lease, you should first think ahead and ask yourself whether you’re willing to make monthly lease payments for the duration of your system’s lifespan. If not, you may want to consider another financing option.

As previously mentioned, with a solar lease, the leasing company owns the panels and will usually be responsible for any maintenance. Some companies also offer advanced services such as panel monitoring and online payments.

A solar lease contract will also spell out the price escalator, which is how much your solar lease cost will increase every year. That number should be between 1% and 5%.

Once your contract ends, you will have the option to renew the lease or have the company remove the panels. You may also be able to purchase the panels at a price stated in your contract.

If you plan to sell your house while still under a leasing contract, most contracts require you to transfer the lease to the new buyer or buy out the leased panels. The cost to buy these panels, however, tends to be above the market rate of the used panels. This aspect of many leasing contracts can complicate home sales.

Solar Power Purchase Agreement (PPA) vs. Lease

When reading up on solar leases, you may have also heard of something called a PPA. While this is very similar to a lease, the two options aren’t identical.

Both options tend to offer free installation and require regular payments to another company that owns the panels. They also both have long-term contracts that include a price escalator.

That said, with a solar lease, you pay the leasing company a fixed amount every month to use the solar panels’ energy. With a PPA, on the other hand, the amount you pay varies based on how much energy you use. For this reason, PPAs tend to be more popular among lower-energy users.

Explore our guide to solar PPAs vs. leases for a comprehensive comparison of these two options.

Alternative Ways to Finance Solar Panels

We get it — investing in solar is a major decision, and not everyone is ready to purchase an entire solar system right this moment.

If you’re looking to install solar panels without paying for an entire system upfront, there are spaced-out financing options available that don’t involve leasing. Let’s take a look at some that we recommend.

Secure a Solar Loan

Firstly, you could take out a solar loan.

A Residential Property-Assessed Clean Energy (R-PACE) loan is a great option for making long-term, low-cost payments to your solar panels with an end goal of owning the panels. They’re secured loans that attach the cost of your solar panels to your property tax, and usually have a lower APR (between 3% and 8.5%).

Alternatively, you can secure a solar loan through your bank, a credit union, or a government program.

Finance Through Your Solar Installer

Another option is to finance through your solar company. In many cases, installers have formed partnerships with lenders to secure lower-interest loans for their customers. In this case, your installer does the work for you and makes securing a loan easy.

Of course, if you can afford it, the best solar financing option is an upfront cash purchase. With this option, once you purchase your system, you’ve paid for 25+ years’ worth of solar energy — no interest, no more electric bills, just clean energy that pays for itself.

Should You Lease or Buy Solar Panels?

The days of unaffordable solar are coming to an end. While solar leasing was understandably popular a decade ago when residential solar systems cost about 50% more, you’re probably better off buying solar panels today.

What’s more, warranties offered by solar component manufacturers can last up to 25 years, putting to rest concerns about the responsibility for panel damage falling on you.

In short, as long as you qualify for the federal tax credit or a solar loan, there isn’t a great reason to pursue a lease over another solar financing option.

This holds especially true with Solartap. Our low-cost residential solar systems come at a fraction of the cost of other major players, thanks to our middleman-free business model and contractor relationships.

Contact the professionals at Solartap today or get a free quote using our solar panel calculator.