The future of energy is renewable, and environmental scientists aren't the only ones who see it. Federal and local governments alike offer incentives to invest in clean energy like solar panels to encourage a shift away from fossil fuel dependence.

That's right — while solar panels are still an investment, you can claim tax incentives, rebates, and more from the government to make them more affordable. In this guide, we unpack solar panel incentives by state so that you can claim as many benefits as possible in your transition to solar power.

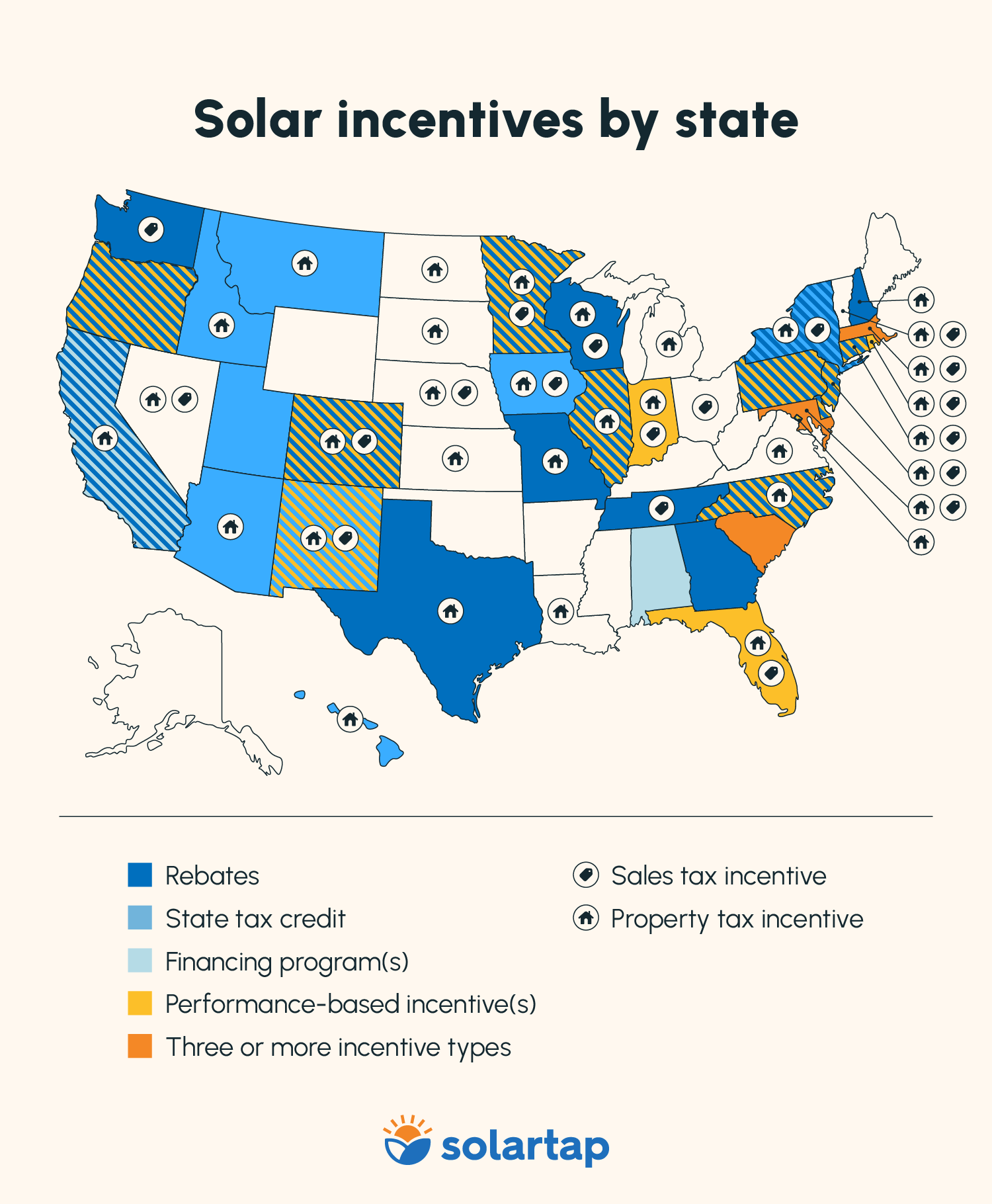

Solar Incentives By State

Below, we direct you to your state's solar panel incentives courtesy of the Database of State Incentives for Renewables & Efficiency (or DSIRE) and unpack some key incentives in each state. Some of the below incentives have some stipulations, so be sure to do some research before counting on claiming them.

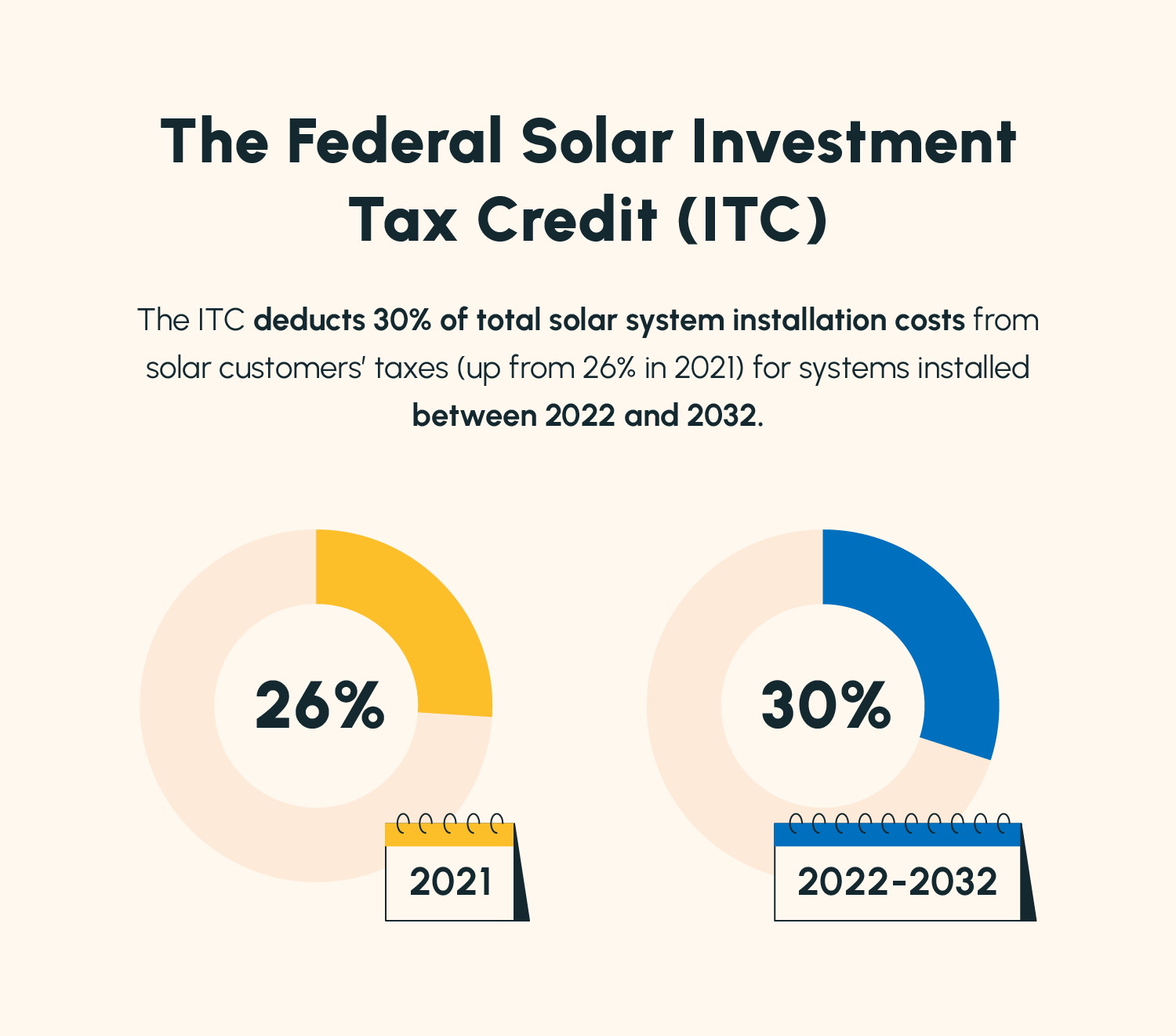

The Federal Solar Investment Tax Credit (Solar ITC)

The Federal Solar Investment Tax Credit (ITC) is the best known and most widely claimed solar incentive. It enables you to claim a portion of your system's total cost on your federal tax return.

The credit constitutes 30% the cost of your system through 2032. If your system cost comes out to $20,000 total, you'd save $6,000 with the ITC.

So are you eligible? If you live in the U.S., owe federal taxes, and own rather than lease your solar panel system, then yes! To apply, attach IRS Form 5695 to your federal tax return.

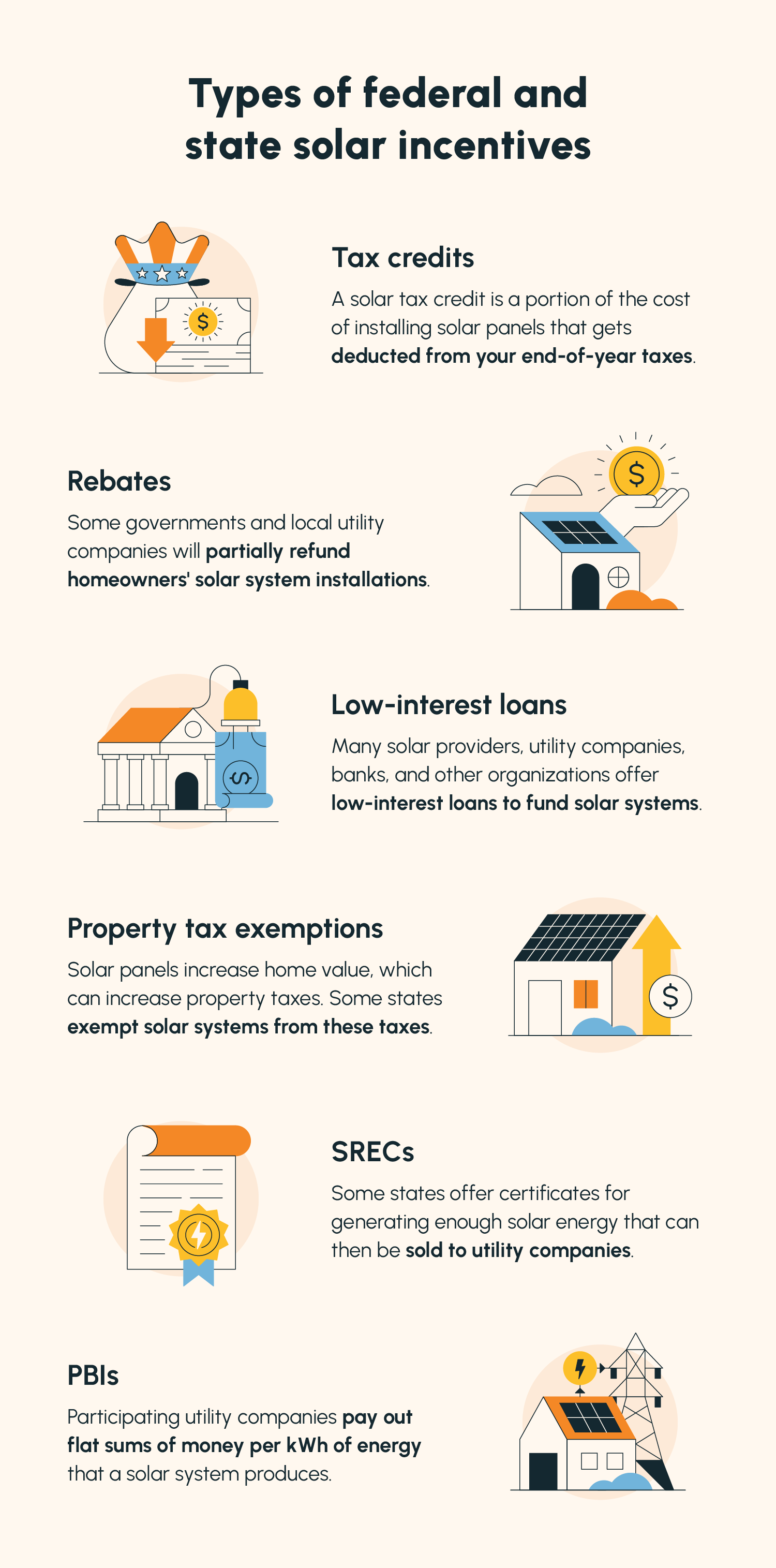

6 Types of Solar Incentives

The ITC isn't the only way federal and local governments support residential solar investments. Check out all the other benefits you can claim below.

Tax Credits

Solar tax credits (like the ITC) are deductions from your end-of-year taxes for investing in solar. You can claim multiple tax credits — both the ITC and any credits your state offers.

Eligibility criteria: Must live in the U.S. and file your federal and/or state taxes.

Government and Utility Rebates

Rebates are partial refunds for the cost of installing a solar panel system. A lot of organizations may offer rebate programs but they're most often granted by either the government or your local utility.

Eligibility criteria: Varies by locale, income, and program.

Low-Interest Loans

If you've ever taken out a loan — whether that be for school, a car, or a home — you're well aware that interest rates can add up. Thankfully, high interest rates are uncommon for renewable energy projects like solar panel systems. Plenty of solar providers, utility companies, and financing companies (some of which are solar-specific) offer low-interest loans to make solar system installation affordable.

Eligibility criteria: Varies by provider but generally requires a good credit score and a specific down payment.

Property Tax Reductions

One common concern among potential solar customers is that their property taxes will increase with a solar system installed on their property. But some states exempt solar systems from property taxes, meaning your home value increases when you install your system without also increasing your property taxes.

Eligibility criteria: Must live in a participating state.

Solar Renewable Energy Certificates (SRECs)

A Solar Renewable Energy Certificate (SREC) is a state-level solar energy incentive. In participating states, you can collect certificates as rewards for generating certain amounts of solar power (one SREC per 1,000 kWh generated) then sell those certificates to utility companies. Utility companies have quotas for solar energy generation, and SRECs can help them meet those quotas without producing solar energy themselves.

Since every state's clean energy supply is different, an SREC's value varies significantly by state, anywhere between $5 and $450 per SREC. If you live in a state without many (or any) solar incentives, selling SRECs is a great way to still make money off of your system.

Eligibility criteria: Must live in a participating state.

Performance-Based Incentives (PBIs)

If you live in an area that offers a net metering program, you can get paid by your local utility company for generating solar energy. These performance-based incentives (PBIs) usually offer a flat rate per kWh.

Eligibility criteria: Your local utility company must participate in a net metering program.

How to Claim Solar Panel Incentives

As we explained earlier, applying for the ITC is easy — just attach IRS Form 5695 to your federal tax return (instructions for filling out the form are available here).

Claiming state incentives is a bit more case-by-case. The first step is to identify who offers them. This may be your state government, a more local government, your utility company, or your solar provider. Then, contact a representative and ask how you can enroll or apply.

When in doubt, explore your state's DSIRE page and research the specific solar incentives you'd like to claim.

Solar Incentives FAQ

It takes some personal research to determine which solar incentives are available to you, and there's quite a bit of misinformation out there about how to reduce the cost of solar. We answer some common questions about solar incentives below to clear up any confusion.

How Do I Get Free Solar Panels From the Government?

Unfortunately, there's no such thing as free solar panels. No state government offers a program that totally pays for solar panel system installations. However, some states offer rebates and subsidies to help offset the cost.

Can I Claim Solar Incentives With a Solar PPA or Lease?

No, you cannot claim solar incentives with a solar PPA or lease. Under these agreements, whatever company rents out their solar panels to you receives these benefits. You have to own the solar system to qualify for both federal and local incentives.

What States Have the Best Solar Incentives?

While a lot of states offer solar incentives, New York, Rhode Island, and Iowa deserve honorable mentions. From property and sales tax exemptions to statewide net metering policies, these states offer comprehensive support of solar panel installations.

You don't have to figure out which incentives you qualify for alone. Solartap's network of contractors are there to help you identify and claim everything you qualify for in your area. Get started with Solartap by getting a free quote today.