If you’re currently deciding how to finance solar panels, there’s a good chance you’ve heard about solar power purchase agreements (PPAs) and solar leases. These terms are often used interchangeably, though they have some key differences.

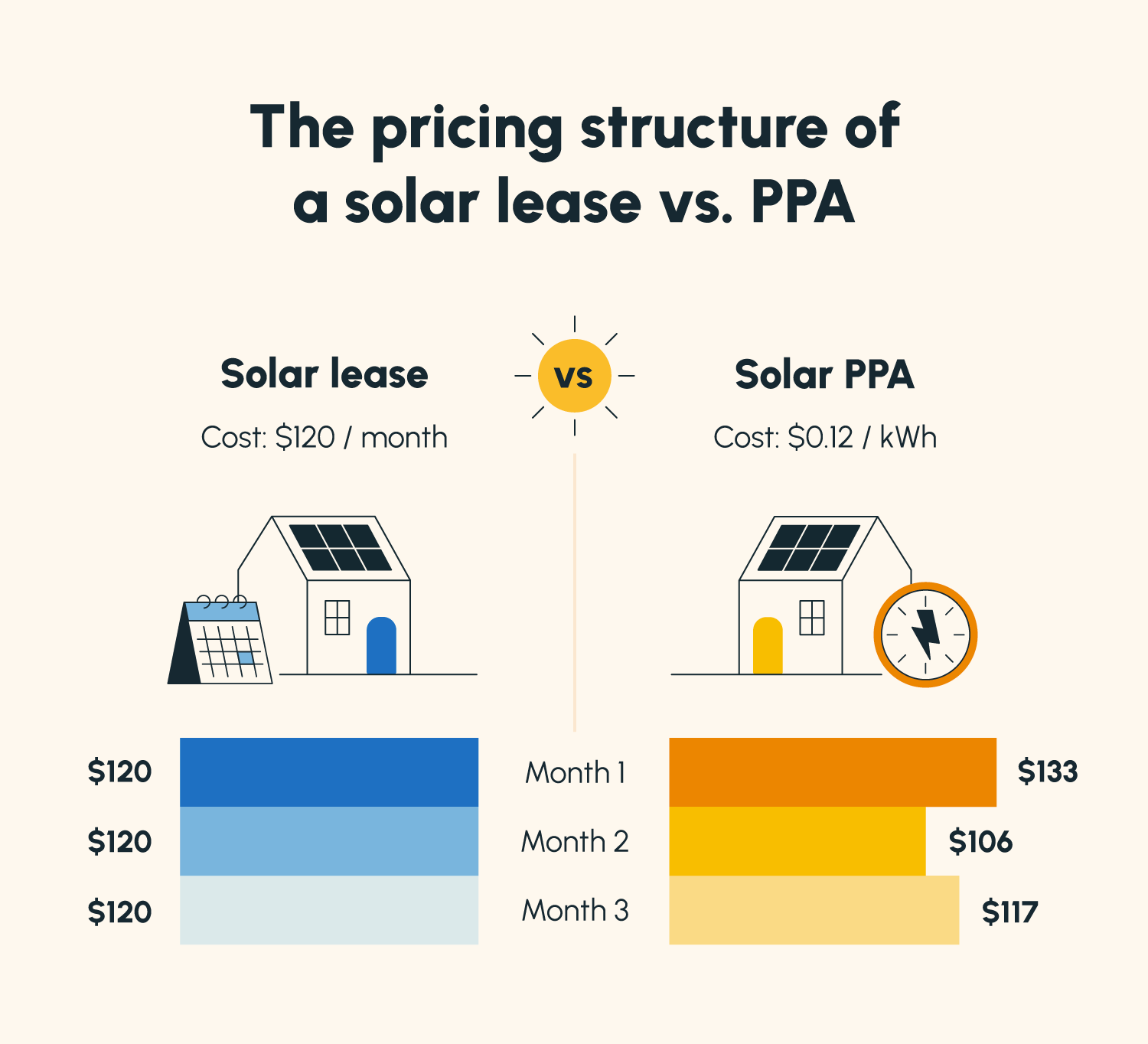

Solar leases and solar PPAs are both solar panel financing options in which a leasing (or PPA) company owns the solar panels on your roof. With a lease, you pay a fixed monthly fee to use the solar panels, whereas with a PPA, you pay for the electricity generated by the solar panels, which can fluctuate.

In this guide, we’ll unpack the solar PPA vs. lease debate and discuss which solar financing option is right for you.

What Is a Solar Lease?

A solar lease is a solar panel financing option in which a homeowner pays a flat fee each month to use solar panels owned and installed by a leasing company.

Solar leasing has historically been a popular way for homeowners to install solar panels without needing to pay an upfront cost for materials and installation. In most cases, these costs are covered by the solar provider.

With leasing solar, the homeowner’s relationship with their utility company is the same as it is when owning solar. Through net metering, they can still buy additional electricity from and sell surplus electricity to the grid.

What Is a Solar PPA?

A solar PPA program is a solar panel financing option in which a PPA company installs their own panels on a homeowner’s roof and charges the homeowner for each kilowatt hour (kWh) they use.

Usually, this means that the homeowner’s bill fluctuates from month to month based on their energy use, though fixed monthly payment plans are usually available as well.

The cost of a PPA varies depending on the homeowner’s location, the price of electricity at the time, and who the installer is.

Solar PPA vs. Solar Lease

As you can already tell, solar PPAs and leases have a lot in common. Let’s walk through the more granular similarities and differences between these solar financing options.

Similarities

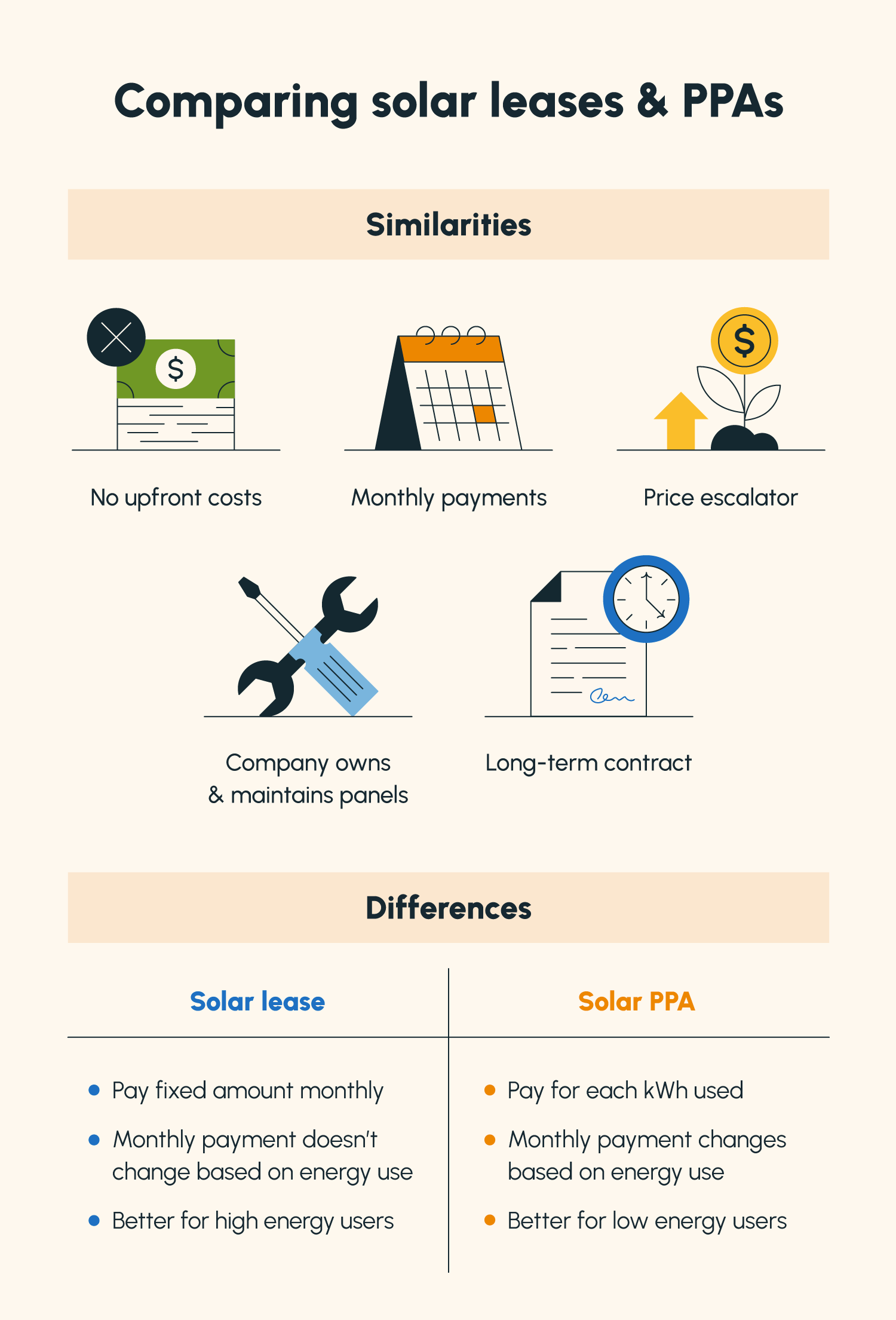

Solar leases and PPAs are both ways to save money on renewable energy without owning your own solar panels. Here are some other ways they parallel each other:

- Don’t include upfront costs: Leasing and PPA companies are commonly known for their “0% down” business model. While the long-term payoff isn’t nearly as significant as it is when buying solar, this model tends to attract homeowners who worry about the initial cost of solar.

- Require monthly payments: With both a PPA and a lease, you’ll be making monthly payments for the entire duration of your contract. You aren’t paying to own the panels, but rather paying to use them.

- Include a price escalator: Since the cost of electricity increases regularly, solar PPAs and leases have price escalators baked into their contracts. With either option, you can expect your monthly bill to increase 1%-5% annually.

- Put responsibility on the company: Since the leasing or PPA company owns the solar panels, they are responsible for their maintenance. Homeowners that pursue either option don’t have to worry about monitoring or fixing the panels.

-

Lock you into a long contract: Contracts for both solar leases and solar PPAs last 20-25 years — about the length of a solar system’s lifetime. For either option, it’s important to think of the long term and consider whether you’ll want to own your solar panels at some point. If so, you might consider another financing option.

Differences

Solar leases and PPAs are very similar, but the way you pay to use the panels differs quite a bit.

- Fixed vs. fluctuating payments: With a solar lease, you know exactly what you’ll be paying each month because it’s spelled out in your contract. With a solar PPA, although the contract specifies a price per kWh (e.g., $0.12/kWh), you’ll almost certainly be using different amounts of energy from month to month, so your bill will fluctuate.

- Relevance of energy usage: Since solar PPAs charge by the kWh, they’re better fit for low energy users than solar leases. Homeowners who use more energy will likely save more with a solar lease than with a PPA.

Should You Get a Lease vs. a PPA, or Just Purchase Your Own Panels?

Solar leases and PPAs have short-term appeal due to their lack of upfront costs. However, you will likely get significantly higher returns by financing solar panels with the goal of owning them, whether that be through a cash purchase or a loan.

After all, the majority of solar loans are paid off in 12 years or less. That means those who finance their solar through a loan as opposed to a PPA or lease get, on average, eight to 13 years worth of fully paid-off energy from their panels. Meanwhile, those leasing or renting continue to pay monthly for their panels for all 20-25 years.

There are, of course, a few conditions when a lease or PPA may seem to make more sense than another financing option.

- If you have low tax liability: When you purchase your own solar system, you get to claim the 30% Federal Solar Investment Tax Credit (ITC). However, if your tax liability isn’t high enough, you may miss out on some of this credit. While it can be a bummer not to qualify for the whole ITC, it’s important to remember that you wouldn’t get the ITC with a lease or a PPA, either — the company would get it.

- If you have a very low credit score: Taking out a solar loan often requires decent credit. If your credit is suffering, there isn’t a very high chance you’ll be approved for a loan until it’s improved. That said, some solar installers partner with lenders to help you finance solar panels. Consider shopping around to see if you can figure out an arrangement that works for you.

- If you can’t afford a down payment: Unlike solar leases and PPAs, a down payment is required to purchase and own your own solar system. If you cannot afford the down payment or are set on immediately saving on electricity (rather than saving significantly more in the long run), you may be more drawn to a PPA or lease.

The answer to the solar PPA vs. purchase debate is pretty simple: In most instances, you’re better off purchasing your own solar system. Not only is solar less expensive than ever before, but low-interest loans also make buying solar very achievable.

Plus, the long-term payoff of a solar purchase is often tenfold that of a loan or PPA. See the image below for a visual comparison of this payoff.

Solar PPA vs. Lease vs. Purchase FAQ

Let’s revisit some common questions about solar PPAs and leases, as well as how they differ from purchasing your own solar system.

How Does a PPA Work?

With a solar PPA, the PPA company installs their own panels on a homeowner’s roof, usually for little to no upfront cost. Unlike a lease’s flat monthly fee, the company charges the homeowner for each kilowatt hour (kWh) that the homeowner uses.

Essentially, the more energy the homeowner uses from the panels, the more they pay.

Can You Buy Out a Solar PPA?

Most PPA agreements include buyout provisions. Every contract is different, so don’t count on being able to buy out the PPA soon after installation. An “early” buyout is usually considered seven to 10 years after the start of the contract.

Ultimately, buying out a PPA tends to be a retroactive move after a party realizes that they could make more by owning a solar system. For this reason, purchasing a solar system from the beginning is the most profitable and hassle-free option.

Is It Better to Lease or Buy Solar?

While not everyone may be in the place to immediately buy their own solar system through a cash purchase, buying solar panels offers a far better payoff than a lease or PPA.

Only by financing your own system do you receive benefits such as the federal solar investment tax credit (ITC) and ultimately reach a point where you’re generating your own sustainable energy for free.

With Solartap, the answer is even simpler. We’ll help you install your own system and start producing renewable energy with long-term payoffs at a fraction of the cost of other providers.